Comparing Fathom Realty’s Revenue Share Models: Max Plan vs. Share Plan with LPT Realty

Real estate agents usually seek brokerages with compensation models that enhance their commission income and offer substantial revenue share opportunities. This article contrasts Fathom Realty’s Max Plan and Share Plan with LPT Realty’s only compensation plan that offers revenue share, demonstrating why Fathom Realty stands out as a superior choice for agents. In this article, I will compare LPT’s vs Fathom’s rev share.

It is important to note that LPT Realty has another compensation plan that offers a flat transaction fee of $500, but this plan does not offer revenue share and since that is the focus of the article, I will not spend time on it.

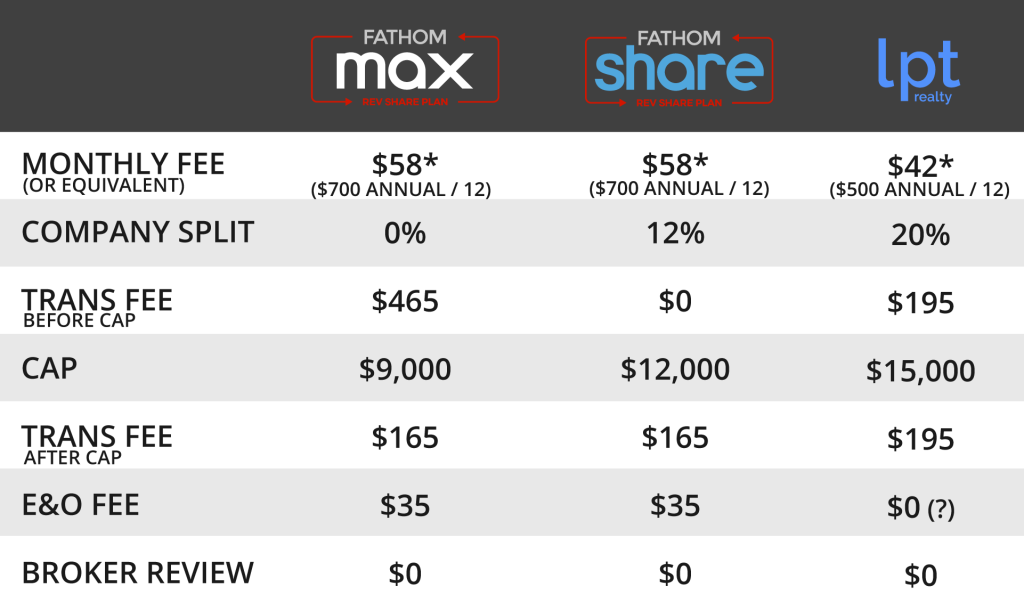

Brokerage Fees Comparison – Fathom vs LPT Realty

Fathom Realty’s Max Plan distinguishes itself with a flat transaction fee of only $465 while still offering revenue share, allowing agents to retain most of their commissions until they hit their annual Cap and earn income on the agents they recruit. On the other hand, LPT Realty charges a transaction fee before the Cap in addition to a percentage split of 20%. Fathom’s Share Plan, with its 12% split, is night and day better than LPT’s 20% commission split. Additionally, Fathom’s lower transaction fees and lower Cap amounts are designed to optimize agent earnings.

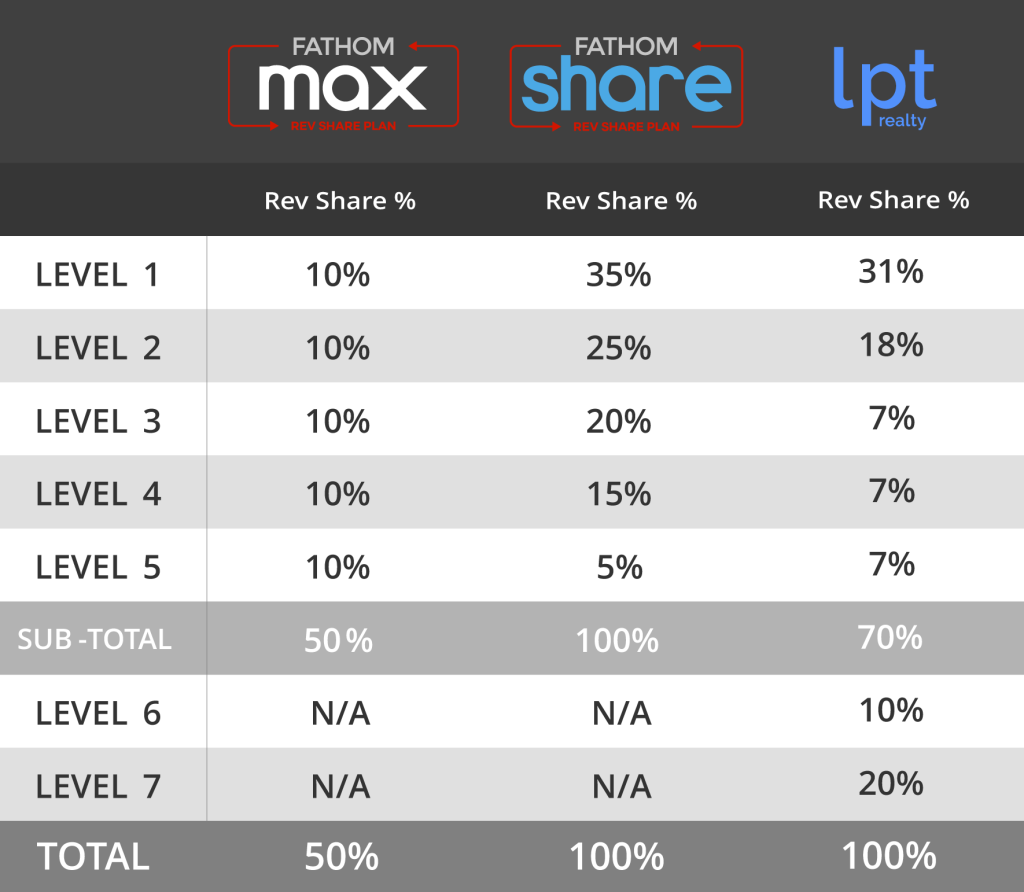

Revenue Share Comparison – Fathom vs LPT Realty

Note: Each brokerage calculates revenue share differently. To provide a fair comparison, we normalized the percentages by calculating the actual share from the adjusted company split.

Fathom Realty’s Share Plan presents a more desirable revenue share model, offering far higher percentages across the initial five levels compared to LPT Realty. This enhanced structure allows Fathom agents to generate substantially more passive income over time through their recruiting efforts, making Fathom a more attractive choice for agents focused on building a strong and profitable revenue share network.

Learn More About Fathom’s Revenue Share

Detailed Comparison – Fathom vs LPT Realty

1. Monthly Fees and Company Splits

- Fathom Realty (Max Plan): $700 annual fee ($58 monthly equivalent), low flat transaction fee of only $465.

- Fathom Realty (Share Plan): $700 annual fee ($58 monthly equivalent), 12% company split.

- LPT Realty: $42 monthly fee ($504 annually), 20% company split.

Summary: Fathom’s annual fees are $700 compared to LPT’s lower $504. However, LPT charges this in monthly installments whereas Fathom does not charge anything per month and only collects the fee when a Fathom agent closes a sale. This, combined with significantly lower company splits, enables Fathom agents to retain more of their commissions. This structure is particularly beneficial for high-performing agents who want to maximize their earnings.

2. Transaction Fees and Cap Amounts

- Fathom Realty (Max Plan): $465 transaction fee before Cap, $9,000 Cap, $165 transaction fee after Cap.

- Fathom Realty (Share Plan): 12% commission split before Cap, $12,000 Cap, $165 transaction fee after Cap.

- LPT Realty: 20% commission split plus a flat $195 fee before Cap, $15,000 Cap, $195 transaction fee after Cap.

Summary: For the available revenue share plans, Fathom Realty’s Max Plan has a far lower transaction fee of only $465 per sale compared to LPT Realty’s 20% commission split plus an additional $195 transaction fee. Additionally, the Max Plan’s Cap is $6,000 lower than LPT’s, resulting in higher net earnings for agents. The Share Plan’s 12% split before Cap also offers an 40% advantage over LPT’s 20% split. Even the Share Plan’s Cap is 20% lower than LPT’s Cap of $15,000. Ultimately, Fathom agents pay less due to the lower split, lower Cap, and lower flat transaction fee post-Cap. Both Fathom plans ensure agents earn a higher net income compared to those at LPT Realty.

3. Revenue Share Levels

- Fathom Realty (Max Plan): 10% revenue share at all five levels

- Fathom Realty (Share Plan): 35% level 1; 25% level 2; 20% level 3; 15% level 4; 5% level 5

- LPT Realty: 31% level 1; 18% level 2; 7% level 3; 7% level 4; 7% level 5; 10% level 6; 20% level 7.

Summary: Fathom’s Share Plan offers far higher revenue share percentages across the first 5 levels compared to LPT Realty. For instance, at Level 1, Fathom provides 35% which is 13% higher than LPT’s 31% revenue share in level 1, offering better incentives for agents to recruit new members. The first level is crucial since it’s the only level agents can directly control, making it deserving of the highest percentage. At level 5, Fathom agents on the Share Plan reach 100% compared to LPT agents only receiving 70%. Even Fathom’s Max Plan’s revenue share is very competitive to LPT’s revenue share at level 5. An agent with LPT would have to reach all 7 levels before unlocking 100% which may never happen.

Why Choose Fathom Realty?

Increased Earnings Potential: With Fathom Realty’s Max Plan and Share Plan, agents benefit from lower fees and greater revenue share percentages, allowing them to maximize income from both their own sales and their recruitment activities.

Greater Flexibility: Fathom Realty offers agents the choice between the Max Plan and the Share Plan, ensuring they can select the option that aligns best with their business needs and objectives. Additionally, agents can switch their chosen plan once per anniversary year to better fit their evolving goals and objectives.

Consistent Growth and Security: Fathom Realty’s compensation structures are crafted to draw in and retain real estate agents, promoting steady growth for both individual agents and the company. This approach provides a reliable and fulfilling career path for agents.

Fathom Realty’s Max Plan and Share Plan provides superior financial benefits compared to LPT Realty. Agents aiming to increase their earnings and take advantage of a robust revenue share model will find Fathom Realty the best choice.